Cost of living crisis

Multifaceted conundrum

Namibians have had to confront the global cost of living crisis from a significantly worse off economic position than prior to the Covid-19 pandemic, a new report by the Institute of Public Policy Research states.

Namibians, much like people worldwide, find themselves confronting a pressing cost of living crisis. In brief, here’s why: the country likely faces double-digit inflation, and households are now paying almost twice as much as they did in 2020 to manage their debt, resulting in the income of average consumers falling short of covering their monthly expenses.

Furthermore, having a job alone cannot shield Namibian workers from the looming spectre of poverty.

In a nutshell, these are the main findings of “The Global Cost of Living Crisis from a Namibian Perspective”, a briefing paper by researcher Kitty Mcgirr. The report was released by the Institute of Public Policy Research (IPPR) last week.

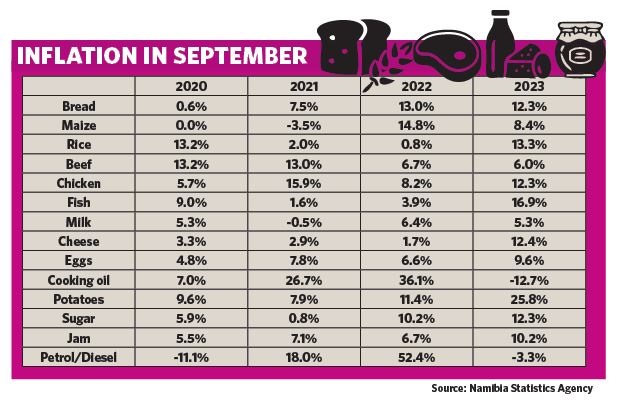

Officially, Namibia’s overall annual inflation rate in September this year was 5.4%. In the same month in 2020, it was 2.4%, according to the Namibia Statistics Agency (NSA). Overall food inflation this September tallied 9.7% compared to 6.6% in the corresponding month in 2020.

Elevated food costs have played a crucial role in shaping consumer spending habits in Namibia, with the typical household allocating around 34% of their monthly budget to their food bill.

‘Heavily outdated framework’

Several local economists who made contributions as part of Mcgirr’s study pointed out that the Namibia Consumer Price Index (NCPI), used as a measure of official inflation, “does not paint a complete picture of current consumption”.

“This is because the NCPI basket continues to be informed by the 2008/09 NHIES [Namibia Household, Income and Expenditure Survey] and thus represents a ‘heavily outdated’ framework for determining the true extent of inflation on the ground,” Mcgirr said.

Namibian economist Theo Klein, who recently joined Oxford Economics Africa, believes Namibia’s official inflation rate should register much higher than what is currently being reported at “somewhere between 12% and 15%”.

The onset of the Covid-19 pandemic in 2020, followed by the Russian invasion of Ukraine in 2022, is widely acknowledged as the principal driving force behind the global cost of living crisis.

The prevailing socio-economic difficulties that existed in Namibian society before the cost of living crisis emerged have imposed significant structural constraints on individuals' capacity to cope with the additional financial burdens resulting from the crisis, Mcgirr said.

With the country experiencing the world's second-highest levels of both income inequality and unemployment, Namibian households are particularly vulnerable to the various financial challenges they face at this time, she added.

Loss of income

Another noteworthy characteristic of the Namibian economy before the cost of living crisis was the simultaneous presence of economic growth and consistently high levels of unemployment, an unusual combination that underscores the existence of "structural deficiencies" within both the economy and the labour market, according to Mcgirr.

After the pandemic erupted, the Namibian job market suffered even more as widespread business closures and downsizing led to a wave of job cuts and reduced spending.

A study by Survey Warehouse, commissioned by the Namibia Employer’s Federation (NEF), estimated that 815 registered companies and closed corporations voluntarily deregistered between January 2020 and February 2021 after failing to generate vital profit turnover to sustain operations in the pandemic.

A separate research study commissioned by the NEF and done by Survey Warehouse showed that 36% of Namibians had experienced reduced working hours due to the pandemic, presumably leading to a corresponding decrease in their wages and salaries.

This discovery is corroborated by another NEF study focusing on the pandemic's impact on businesses, which found that 39% of surveyed businesses had already implemented wage reductions, while an additional 8% had intentions to do so in the near future.

Of these wage reductions, more than 40% of businesses indicated that they had already implemented or planned to apply these cuts to over 40% of their workforce.

Wage stagnation

“Wage stagnation has had a particularly harmful effect on the Namibian labour market due to the fact that wages and salaries constitute the main source of income for 48% of households,” Mcgirr said.

“Namibians have had to confront the cost of living crisis from a significantly worse off economic position than prior to the pandemic,” she added.

Mcgirr quoted data stating that the average monthly costs for a single person living in Namibia have risen sharply to an estimated N$8 385, excluding rent, last year.

According to Macrotrends.net, Namibia’s gross national income per capita last year was about N$7 727 per month. In 2019, it was around N$8 344 per month, according to the website.

“Adding the inflationary pressures underpinning the cost of living crisis to the equation, it is increasingly the case that employment in and of itself cannot protect Namibian workers from the threat of poverty.

“On the contrary, it appears that the numbers of ‘working poor’ are growing concomitantly with the spiralling rate of unemployment,” Mcgirr stated.

Rising poverty

Namibians have had to confront the cost of living crisis from a “significantly worse off economic position than prior to the pandemic”, according to Mcgirr. “The overarching effect of each of the above developments has been a greater proportion of Namibians falling into poverty.”

She quoted prime minister Saara Kuugongelwa-Amadhila at the launch of the Sixth National Development Plan (NDP6) earlier this year, saying that the gains Namibia has made in terms of reducing poverty since 2016 have been “almost completely wiped out”.

“I remember we once reduced poverty from 38% to 18%, but now when you look at the new formula for calculating poverty, close to 50% of the population is living in poverty,” Kuugongelwa-Amadhila said at the launch.

Likewise, according to the World Bank's assessment, an extra 200 000 Namibians slipped into poverty in 2020 alone, raising the overall count of individuals living in poverty within the population to 1.6 million.

“The burden of poverty has also been unevenly distributed across the population such that already vulnerable groups are experiencing the largest drop in living standards as a result of the cost-of-living crisis. This is having the effect of further entrenching the extreme income inequality already endemic to Namibian society,” Mcgirr said.

Food insecurity

Growing food security issues represent another key indicator of the rising tide of poverty in Namibian society, Mcgirr said.

A survey conducted by Afrobarometer in 2022, showed 56% of Namibians experience regular shortages of essential life necessities, marking an 11-percentage-point rise compared to 2019. It also reported that that 64% of Namibians went without food at some point during the past year, with 24% enduring food shortages "many times" or "always".

“This mismatch between supply and demand has made food products one of the biggest targets of domestic inflation, leading to price hikes that consumers have had little means to adapt to other than simply consuming less food,” Mcgirr said.

According to the latest IPC Acute Food Insecurity Analysis, approximately 695 000, or 26% of the population, are estimated to face high levels of acute food insecurity until next March. These people require “urgent humanitarian assistance”, according to the report.

Indebtedness

Simultaneously with the declining financial ability to meet crucial household costs, household debt has been steadily on the rise, Mcgirr noted.

“According to the Financial Stability Report for 2022 published by the Bank of Namibia (BoN) and the Namibia Financial Institutions Supervisory Authority (Namfisa), the average Namibian household’s debt servicing costs rose from 9% in 2020 to 17.8% in 2022.

“In more concrete terms, monthly repayments for a house valued at N$1.2 million have increased by over N$2 590 over the course of the last two years,” Mcgirr said.

A TransUnion survey, presented recently at the inaugural Financial Services Summit in Namibia, showed 36% of consumers experienced a drop in income in the last three months, while 45% anticipated being unable to pay their current bills and loans in full.

According to TransUnion’s third quarter Consumer Pulse Study, one of the significant factors contributing to the decrease in household income was employment losses, with 27% of consumers reporting that someone in their household lost their job over the past month.

Other factors impacting decreased income included wage or salary reductions (16%) and owning a small business that closed, or saw orders dry up.

“Many consumers have been forced to adjust their household budgets in response to these challenges, with 56% cutting back on discretionary spending – such as dining out, travel and entertainment – over the past three months,” said Lara Burger, country manager at TransUnion Namibia.

‘Ill-prepared’

“While there is no ‘good’ time for any society to experience a global pandemic followed by unprecedented economic and geopolitical disruptions culminating in a global cost of living crisis, Namibia was particularly ill-prepared for the challenges brought forth by the compounding crises of last few years,” Mcgirr said.

The origins of these challenges in the Namibian context have been at once international and domestic, she added.

External headwinds include global monetary tightening and a breakdown in global commodity value chains leading to skyrocketing import costs and worsening terms of trade.

Worsening macroeconomic imbalances have also been fuelled by internal factors, most notably the accumulation of high public debt, Mcgirr said.

A growing proportion of state revenue is having to be spent on debt servicing, imposing constraints on government’s policy options with regard to taming inflation and expanding capital expenditure to tackle unemployment and reduce poverty, she explained.

The global cost of living crisis continues to wield the potential to alter the long term developmental trajectories of many low- and middle-income countries, including Namibia, Mcgirr said.

Policy

According to Mcgirr, one policy component of particular concern is the longevity of Namibia’s social protection system which currently serves as a critical lifeline to over one million Namibians.

Government has consistently emphasised the preservation and, in some instances, the expansion of social protection, even in the face of a challenging macroeconomic environment, she added.

This accomplishment deserves recognition, particularly considering that social welfare is often one of the initial sectors to undergo budget reductions in the budgetary balancing efforts of many regional counterparts, Mcgirr said.

“However, the realities of shrinking fiscal space, low to marginal growth prospects, and persisting structural imbalances in the economy and the labour market suggest that the fiscal sustainability of the Namibian welfare state may be reaching its upper limits.

“Thus, to foster the long-term viability of social protection and indeed to strengthen the resilience of the Namibian economy as a whole, public revenue needs to be significantly expanded by ‘absorbing as many people into the labour market as possible ... [to create] a bigger middle-income class’ from which to draw a larger pool of taxes to maintain government redistribution to the poor,” Mcgirr concluded.

Furthermore, having a job alone cannot shield Namibian workers from the looming spectre of poverty.

In a nutshell, these are the main findings of “The Global Cost of Living Crisis from a Namibian Perspective”, a briefing paper by researcher Kitty Mcgirr. The report was released by the Institute of Public Policy Research (IPPR) last week.

Officially, Namibia’s overall annual inflation rate in September this year was 5.4%. In the same month in 2020, it was 2.4%, according to the Namibia Statistics Agency (NSA). Overall food inflation this September tallied 9.7% compared to 6.6% in the corresponding month in 2020.

Elevated food costs have played a crucial role in shaping consumer spending habits in Namibia, with the typical household allocating around 34% of their monthly budget to their food bill.

‘Heavily outdated framework’

Several local economists who made contributions as part of Mcgirr’s study pointed out that the Namibia Consumer Price Index (NCPI), used as a measure of official inflation, “does not paint a complete picture of current consumption”.

“This is because the NCPI basket continues to be informed by the 2008/09 NHIES [Namibia Household, Income and Expenditure Survey] and thus represents a ‘heavily outdated’ framework for determining the true extent of inflation on the ground,” Mcgirr said.

Namibian economist Theo Klein, who recently joined Oxford Economics Africa, believes Namibia’s official inflation rate should register much higher than what is currently being reported at “somewhere between 12% and 15%”.

The onset of the Covid-19 pandemic in 2020, followed by the Russian invasion of Ukraine in 2022, is widely acknowledged as the principal driving force behind the global cost of living crisis.

The prevailing socio-economic difficulties that existed in Namibian society before the cost of living crisis emerged have imposed significant structural constraints on individuals' capacity to cope with the additional financial burdens resulting from the crisis, Mcgirr said.

With the country experiencing the world's second-highest levels of both income inequality and unemployment, Namibian households are particularly vulnerable to the various financial challenges they face at this time, she added.

Loss of income

Another noteworthy characteristic of the Namibian economy before the cost of living crisis was the simultaneous presence of economic growth and consistently high levels of unemployment, an unusual combination that underscores the existence of "structural deficiencies" within both the economy and the labour market, according to Mcgirr.

After the pandemic erupted, the Namibian job market suffered even more as widespread business closures and downsizing led to a wave of job cuts and reduced spending.

A study by Survey Warehouse, commissioned by the Namibia Employer’s Federation (NEF), estimated that 815 registered companies and closed corporations voluntarily deregistered between January 2020 and February 2021 after failing to generate vital profit turnover to sustain operations in the pandemic.

A separate research study commissioned by the NEF and done by Survey Warehouse showed that 36% of Namibians had experienced reduced working hours due to the pandemic, presumably leading to a corresponding decrease in their wages and salaries.

This discovery is corroborated by another NEF study focusing on the pandemic's impact on businesses, which found that 39% of surveyed businesses had already implemented wage reductions, while an additional 8% had intentions to do so in the near future.

Of these wage reductions, more than 40% of businesses indicated that they had already implemented or planned to apply these cuts to over 40% of their workforce.

Wage stagnation

“Wage stagnation has had a particularly harmful effect on the Namibian labour market due to the fact that wages and salaries constitute the main source of income for 48% of households,” Mcgirr said.

“Namibians have had to confront the cost of living crisis from a significantly worse off economic position than prior to the pandemic,” she added.

Mcgirr quoted data stating that the average monthly costs for a single person living in Namibia have risen sharply to an estimated N$8 385, excluding rent, last year.

According to Macrotrends.net, Namibia’s gross national income per capita last year was about N$7 727 per month. In 2019, it was around N$8 344 per month, according to the website.

“Adding the inflationary pressures underpinning the cost of living crisis to the equation, it is increasingly the case that employment in and of itself cannot protect Namibian workers from the threat of poverty.

“On the contrary, it appears that the numbers of ‘working poor’ are growing concomitantly with the spiralling rate of unemployment,” Mcgirr stated.

Rising poverty

Namibians have had to confront the cost of living crisis from a “significantly worse off economic position than prior to the pandemic”, according to Mcgirr. “The overarching effect of each of the above developments has been a greater proportion of Namibians falling into poverty.”

She quoted prime minister Saara Kuugongelwa-Amadhila at the launch of the Sixth National Development Plan (NDP6) earlier this year, saying that the gains Namibia has made in terms of reducing poverty since 2016 have been “almost completely wiped out”.

“I remember we once reduced poverty from 38% to 18%, but now when you look at the new formula for calculating poverty, close to 50% of the population is living in poverty,” Kuugongelwa-Amadhila said at the launch.

Likewise, according to the World Bank's assessment, an extra 200 000 Namibians slipped into poverty in 2020 alone, raising the overall count of individuals living in poverty within the population to 1.6 million.

“The burden of poverty has also been unevenly distributed across the population such that already vulnerable groups are experiencing the largest drop in living standards as a result of the cost-of-living crisis. This is having the effect of further entrenching the extreme income inequality already endemic to Namibian society,” Mcgirr said.

Food insecurity

Growing food security issues represent another key indicator of the rising tide of poverty in Namibian society, Mcgirr said.

A survey conducted by Afrobarometer in 2022, showed 56% of Namibians experience regular shortages of essential life necessities, marking an 11-percentage-point rise compared to 2019. It also reported that that 64% of Namibians went without food at some point during the past year, with 24% enduring food shortages "many times" or "always".

“This mismatch between supply and demand has made food products one of the biggest targets of domestic inflation, leading to price hikes that consumers have had little means to adapt to other than simply consuming less food,” Mcgirr said.

According to the latest IPC Acute Food Insecurity Analysis, approximately 695 000, or 26% of the population, are estimated to face high levels of acute food insecurity until next March. These people require “urgent humanitarian assistance”, according to the report.

Indebtedness

Simultaneously with the declining financial ability to meet crucial household costs, household debt has been steadily on the rise, Mcgirr noted.

“According to the Financial Stability Report for 2022 published by the Bank of Namibia (BoN) and the Namibia Financial Institutions Supervisory Authority (Namfisa), the average Namibian household’s debt servicing costs rose from 9% in 2020 to 17.8% in 2022.

“In more concrete terms, monthly repayments for a house valued at N$1.2 million have increased by over N$2 590 over the course of the last two years,” Mcgirr said.

A TransUnion survey, presented recently at the inaugural Financial Services Summit in Namibia, showed 36% of consumers experienced a drop in income in the last three months, while 45% anticipated being unable to pay their current bills and loans in full.

According to TransUnion’s third quarter Consumer Pulse Study, one of the significant factors contributing to the decrease in household income was employment losses, with 27% of consumers reporting that someone in their household lost their job over the past month.

Other factors impacting decreased income included wage or salary reductions (16%) and owning a small business that closed, or saw orders dry up.

“Many consumers have been forced to adjust their household budgets in response to these challenges, with 56% cutting back on discretionary spending – such as dining out, travel and entertainment – over the past three months,” said Lara Burger, country manager at TransUnion Namibia.

‘Ill-prepared’

“While there is no ‘good’ time for any society to experience a global pandemic followed by unprecedented economic and geopolitical disruptions culminating in a global cost of living crisis, Namibia was particularly ill-prepared for the challenges brought forth by the compounding crises of last few years,” Mcgirr said.

The origins of these challenges in the Namibian context have been at once international and domestic, she added.

External headwinds include global monetary tightening and a breakdown in global commodity value chains leading to skyrocketing import costs and worsening terms of trade.

Worsening macroeconomic imbalances have also been fuelled by internal factors, most notably the accumulation of high public debt, Mcgirr said.

A growing proportion of state revenue is having to be spent on debt servicing, imposing constraints on government’s policy options with regard to taming inflation and expanding capital expenditure to tackle unemployment and reduce poverty, she explained.

The global cost of living crisis continues to wield the potential to alter the long term developmental trajectories of many low- and middle-income countries, including Namibia, Mcgirr said.

Policy

According to Mcgirr, one policy component of particular concern is the longevity of Namibia’s social protection system which currently serves as a critical lifeline to over one million Namibians.

Government has consistently emphasised the preservation and, in some instances, the expansion of social protection, even in the face of a challenging macroeconomic environment, she added.

This accomplishment deserves recognition, particularly considering that social welfare is often one of the initial sectors to undergo budget reductions in the budgetary balancing efforts of many regional counterparts, Mcgirr said.

“However, the realities of shrinking fiscal space, low to marginal growth prospects, and persisting structural imbalances in the economy and the labour market suggest that the fiscal sustainability of the Namibian welfare state may be reaching its upper limits.

“Thus, to foster the long-term viability of social protection and indeed to strengthen the resilience of the Namibian economy as a whole, public revenue needs to be significantly expanded by ‘absorbing as many people into the labour market as possible ... [to create] a bigger middle-income class’ from which to draw a larger pool of taxes to maintain government redistribution to the poor,” Mcgirr concluded.

Kommentaar

Republikein

Geen kommentaar is op hierdie artikel gelaat nie